EFFECTIVE THURSDAY, MARCH 5, 2026 We’re excited to share a preview of several enhancements coming soon to your digital banking experience. These updates are designed to make it easier to view your ...

February 18, 2026

ALL CATEGORIES

- all Categories

- Financial Education

- HerMoney

- Money Management

- Financial Goals

- Savings

- Budgeting

- Fraud Education

- In the Community

- MCCU News

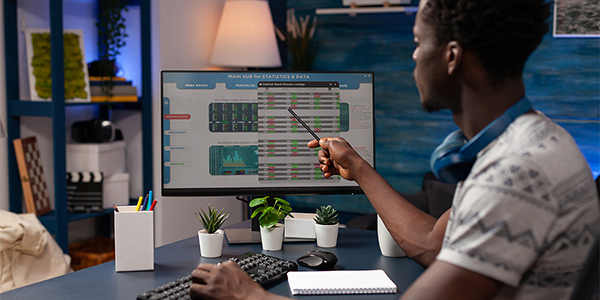

- Investing

- Mortgage

- Retirement

- Cybersecurity

- Money & Kids

- Tax Season

- Credit Score

- Emergency Fund

- Business Banking

- Charitable Giving

- Spending

- College Savings

- Credit Union Benefits

- Debt Solutions

- Digital Banking

- Helping Heroes

- Auto Loans

- Parenthood

- Personal Loans

- Travel Tips

- Credit Cards

- Debit Cards

- Estates & Trusts

- Insurance

- Zelle®

- Direct Deposit

- Members Perks

July 02, 2025

June 04, 2025

June 04, 2025

March 26, 2025

February 28, 2025

February 03, 2025

January 17, 2025

December 17, 2024

December 12, 2024

December 12, 2024

November 14, 2024

October 23, 2024

October 07, 2024

August 28, 2024

May 29, 2024

February 13, 2024

February 13, 2024

December 01, 2023

December 01, 2023

November 02, 2023

November 02, 2023

July 06, 2023

February 23, 2023

February 02, 2023

January 19, 2023

January 09, 2023

-1.jpg)

.jpg)

andIRA_2x1.png)